Give your team the financial wellness benefit that’s trusted by 2,000 businesses and has served 3.5 million employees.

Give your team the financial wellness benefit that’s trusted by 2,000 businesses and has served 3.5 million employees.

Give your team the financial wellness benefit that’s trusted

by 2,000 businesses and has served 3.5 million employees.

What is SmartDollar?

SmartDollar is an employee financial wellness benefit based on Dave Ramsey’s proven principles. These principles, called the Baby Steps, have helped millions of people ditch debt and save wisely over the last 30 years.

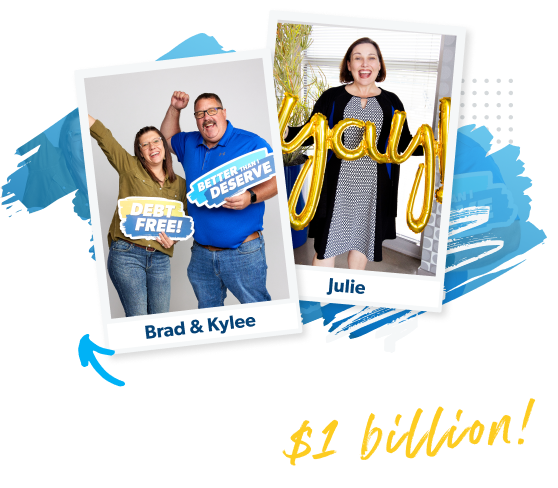

And it’s proven to work!

3 Simple Steps to Bring Financial Wellness to Your Team

Connect With Us

Fill out the form above and we’ll

give you a quick call.

See the Product

Schedule a personalized walk-through of SmartDollar and get your custom quote.

Get Started

Finalize the paperwork and feel good

knowing your employees can start taking

control of their money.

3 Simple Steps to Bring Financial Wellness to Your Team

Connect With Us

Fill out the form above and we’ll give you a quick call.

See the Product

Schedule a personalized walk-through of SmartDollar and get your custom quote.

Get Started

Finalize the paperwork and feel good knowing your employees can start taking control of their money.

What do your

employees get?

employees get?

You can give them access to life-changing financial education with:

Tools for budgeting, saving, and planning for the future

Educational content from financial experts, including

Dave Ramsey

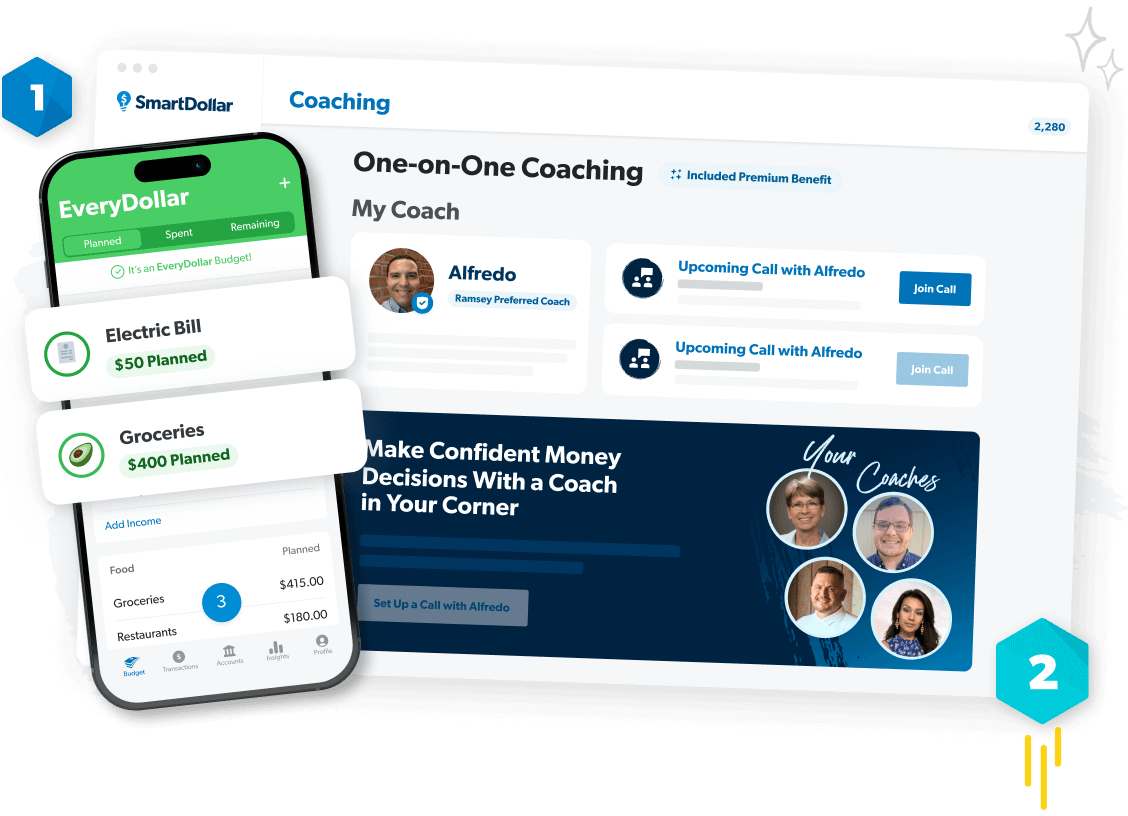

One-on-one and group coaching

What does your

business get?

business get?

You get access to everything you need to

launch and promote SmartDollar, including:

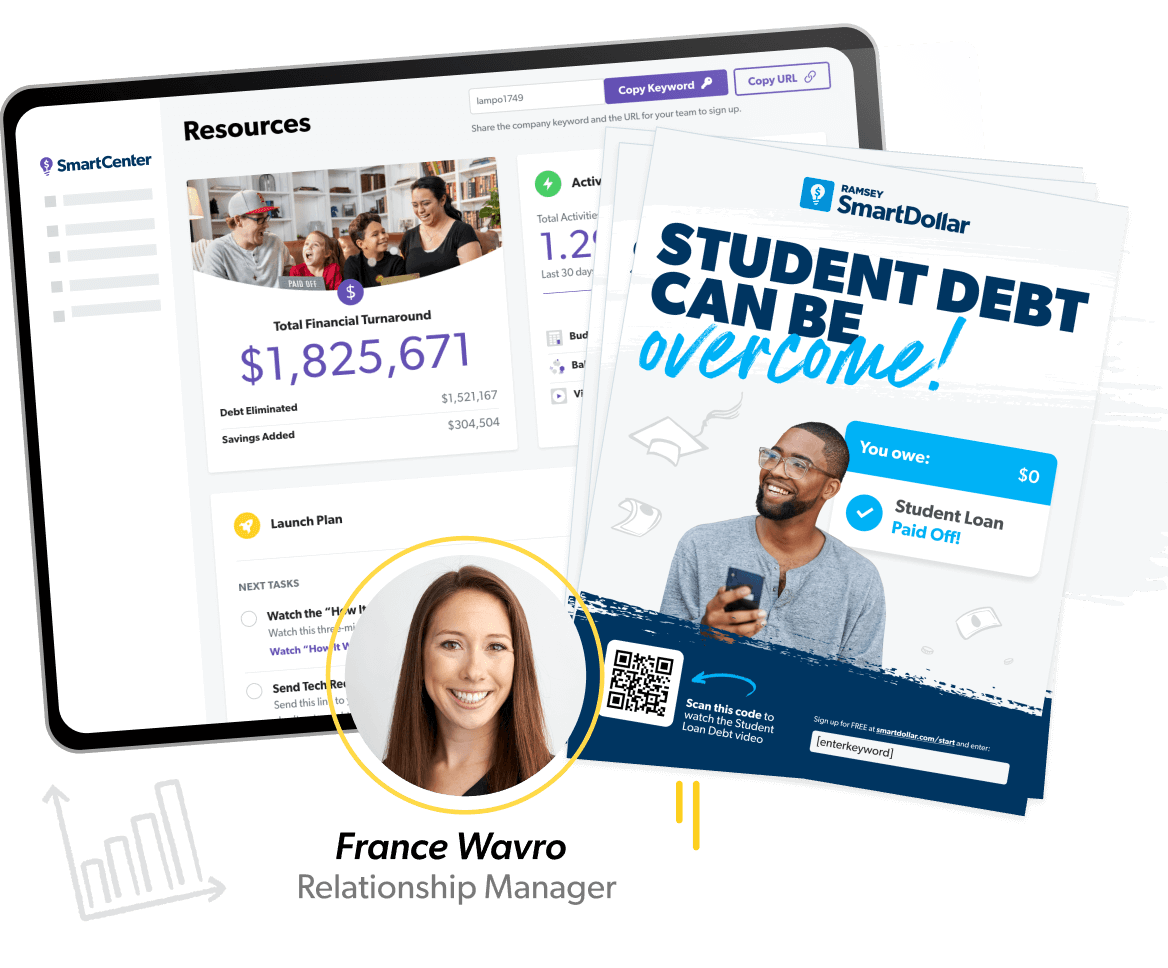

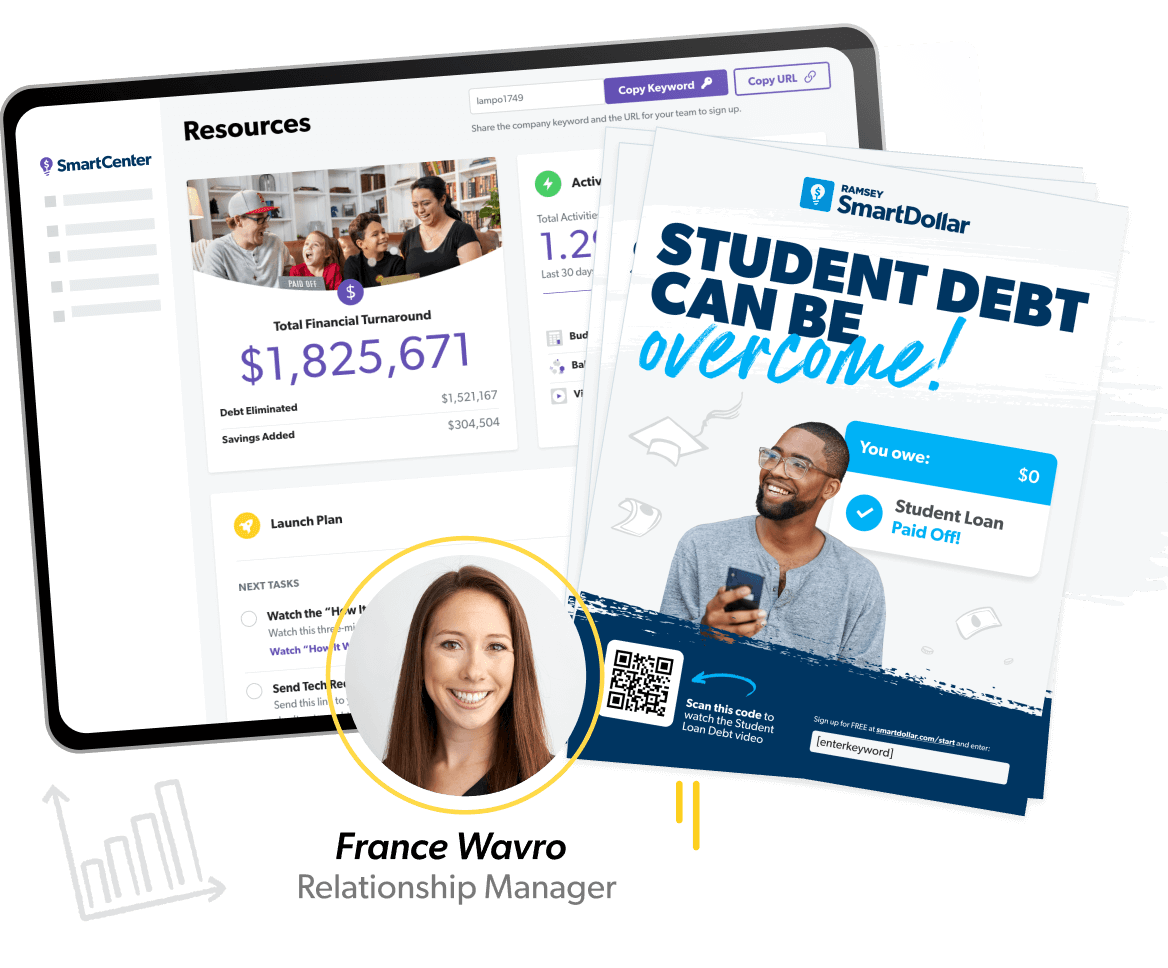

A dedicated relationship manager

A personalized client portal

Ready-to-use promo materials

What do your employees get?

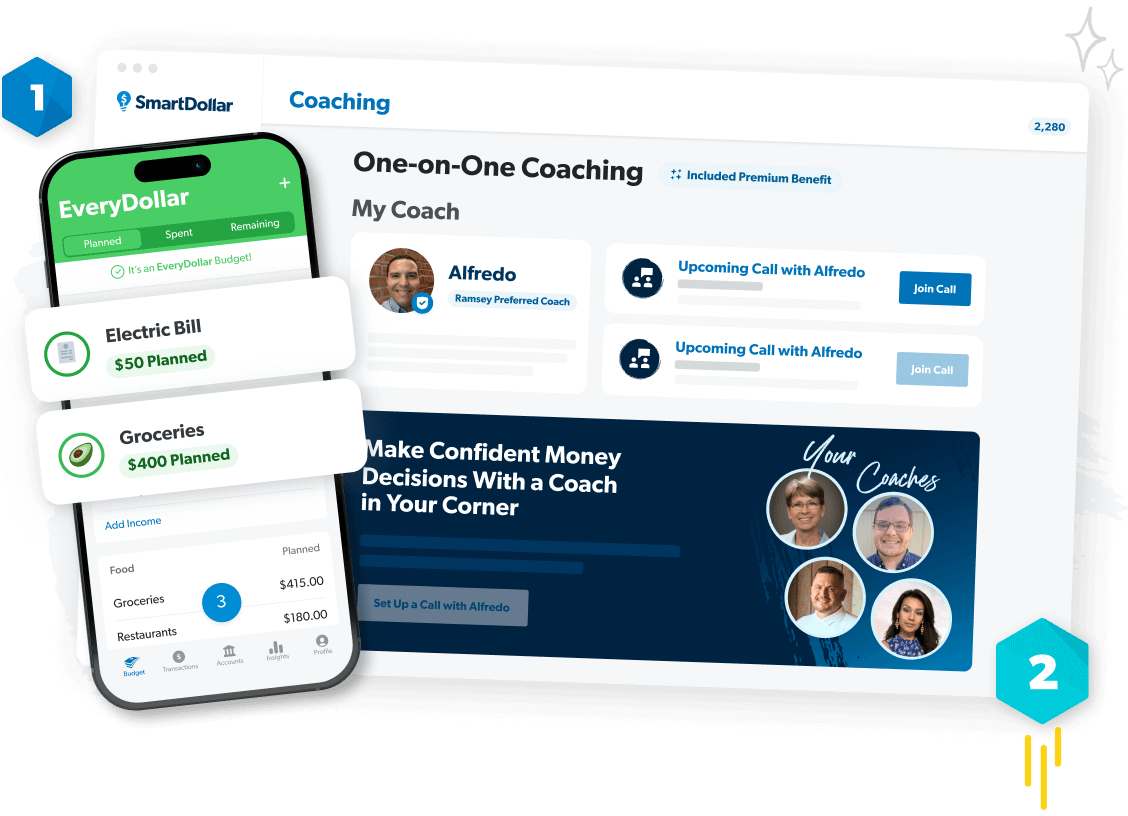

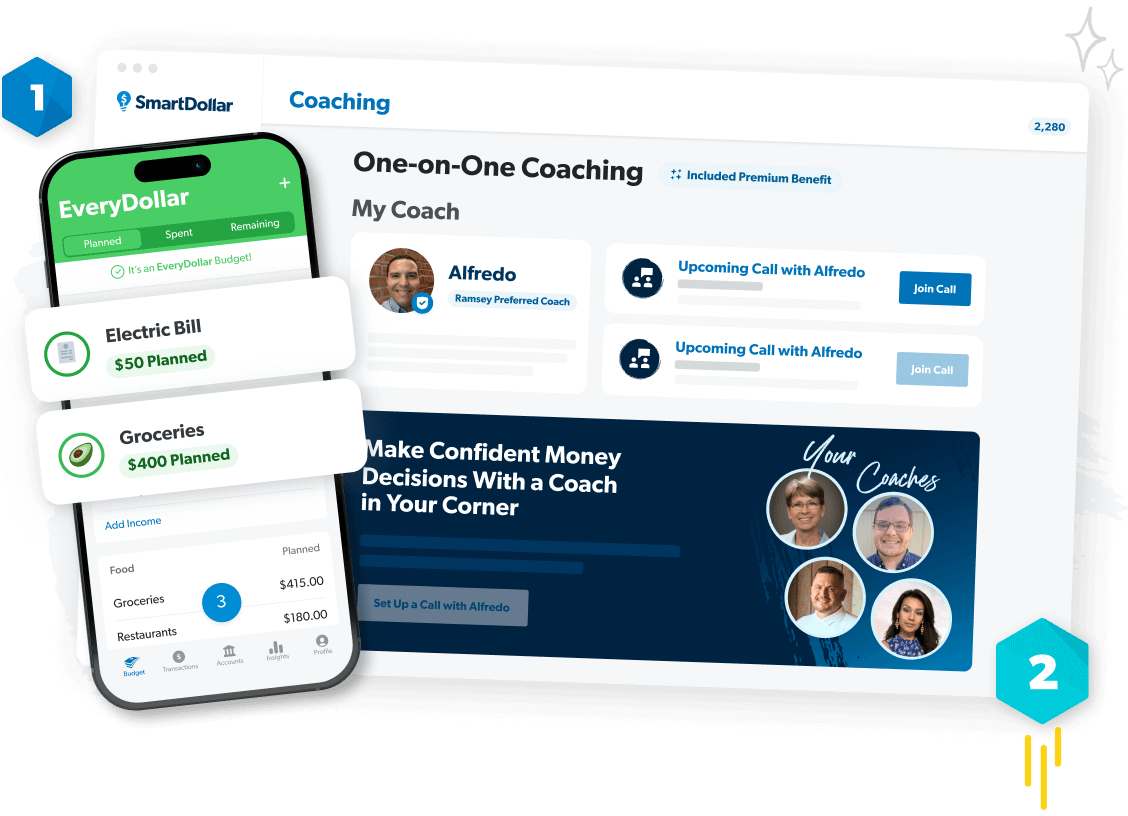

You can give them access to life-changing financial education with:

Tools for budgeting, saving, and planning for the future

Educational content from financial experts, including

Dave Ramsey

One-on-one and group coaching

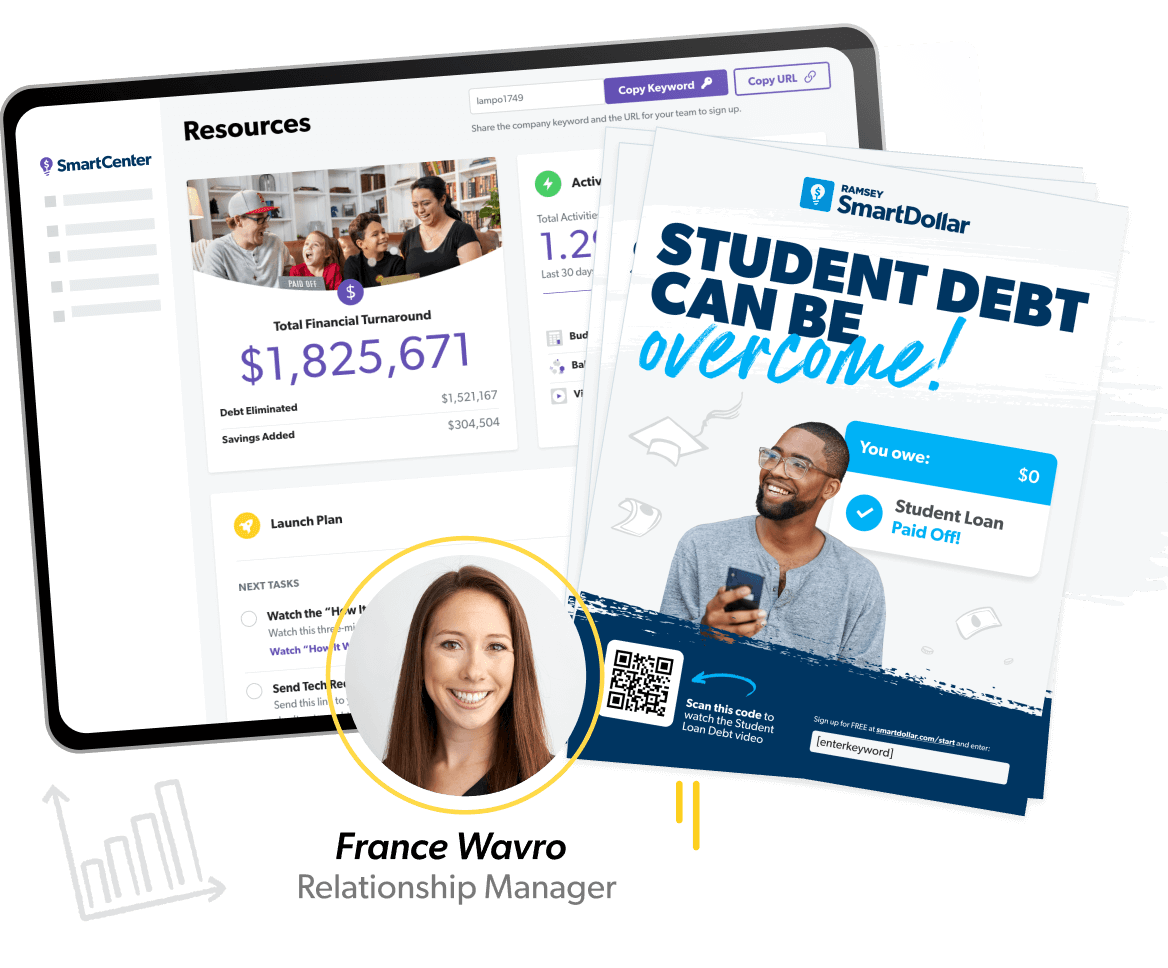

What does your business get?

You get access to everything you need to launch and promote SmartDollar, including:

A dedicated relationship manager

A personalized client portal

Ready-to-use promo materials

What do your employees get?

You can give them access to life-changing

financial education with:

Tools for budgeting, saving, and

planning for the future

Educational content from financial

experts, including Dave Ramsey

One-on-one and group coaching

What does your business get?

You get access to everything you need to

launch and promote SmartDollar, including:

A dedicated relationship manager

A personalized client portal

Ready-to-use promo materials

“SmartDollar stands out because of its reputation. All of the other programs we looked at were new. Sure, they might all have similar features. But at the end of the day, this program has the reputation of really impacting lives.”

“With SmartDollar, our employees aren’t worried about their financial situation. They perform better and are more productive. That’s better patient care!"

“Working with the SmartDollar team is a ton of fun! It feels like an extension of us—just super easy and natural. I don’t think it’s ever hard to work with people who are really trying to help you and help your employees.”

“This has given our employees and students the opportunity to really set themselves up for success, create legacy in their lives, and see ways that they can actually make a plan with their finances. We have heard thank you a lot. And that's really encouraging.”

Companies That Use SmartDollar

Companies That Use SmartDollar

Check out some of our free educational content to help you lead your employees and make a positive impact on your business.

The 2022 SmartDollar Employee Benefits Study

This study covers topics including employee benefits, employee financial and mental health, and other trends impacting today’s workforce.

Check out some of our free educational content to help you lead

your employees and make a positive impact on your business.

The 2022 SmartDollar

Employee Benefits Study

Employee Benefits Study

This study covers topics including employee benefits, employee financial and mental health, and other trends impacting today’s workforce.

Featured In

Have Questions?

-

Will my employees use it?

-

Truth: SmartDollar clients see the highest participation results with their employees when leaders get involved.

That means leaders working the Baby Steps alongside their team, offering incentives, celebrating small (and big) wins, and sending out the prewritten email invitations.

And you don’t have to do it alone. Your dedicated relationship manager will help you encourage your employees to use SmartDollar—whether they’re in the office, in the field or in front of a classroom.

We can’t promise your whole team will sign up—but the ones who work the Baby Steps can change their lives!

-

How does SmartDollar work?

-

With SmartDollar, your employees will have 24/7 access to easy-to-consume content, including the premium version of our budgeting app, EveryDollar, to track their money.

They can pay off debt (we’re looking at you student loans!), save for life’s big emergencies, and finally get excited about their future.

-

How do I roll out SmartDollar to my employees? Do I need to do all the work myself?

-

You’re not alone! You'll have a relationship manager dedicated to your company who’ll help guide you through the implementation process, suggesting the best way to launch SmartDollar to your team. You’ll also have access to promotional materials inside your admin portal.

Plus, group and individual invitations will help you to quickly (and easily) get new employees signed up.

-

Is SmartDollar only for my employees or can I use it too?

-

You can absolutely use it too! Companies have higher success rates with SmartDollar when leaders work the plan.

This could be as easy as showing a SmartDollar video during your current meeting rhythms or more in-depth like scheduling an hour once a month to watch a video, discuss progress, and celebrate together.

But SmartDollar isn’t a class, so even if watching content together isn’t an option, you—and your employees—are able to work the plan and access the tools anywhere, anytime.

-

What if my employees aren’t in an office?

-

A lot of SmartDollar users are on the road, in front of a classroom, on-site or somewhere other than sitting at a desk. That’s okay!

Your employees can access SmartDollar on a desktop or a mobile device so wherever they are, SmartDollar is too. Your dedicated relationship manager can also give you ideas to keep your employees encouraged and on track toward their money goals.